Today, we saw Donald Trump do what he does best: say the quiet part out loud and then backpedal when the backlash hits.

Trump has been flirting with firing the Federal Reserve Chair...that he appointed...because Chair Powell remains focused on his job of long-term economic stability instead of blindly slashing interest rates to juice the economy for Trump’s billionaire buddies. Just this week, new inflation numbers came in hot, a clear reminder that the economy must be handled with care. Trump refuses to take responsibility for why inflation is running hot—the Trump Tariff War. His Tariff Tax has driven up costs and forced the Fed to hold interest rates higher than it otherwise might. Leaving Powell trying to contain Trump’s damage while keeping the American people employed.

But Trump doesn’t want to admit that he’s the problem. He doesn’t want to lose. Instead, he’s lashing out at the Fed and trying to bully Powell into doing what’s politically expedient for himself, instead of what’s economically sound. He’s also dead set on pressuring the Fed to prematurely lower rates, making it cheaper for corporations to borrow and refinance debt. While that sounds like a good thing, if the Fed isn’t cautious, the excess demand created by those borrowings could lead to more inflation.

It’s short-term political gain at the expense of jobs, wages, and long-term stability.

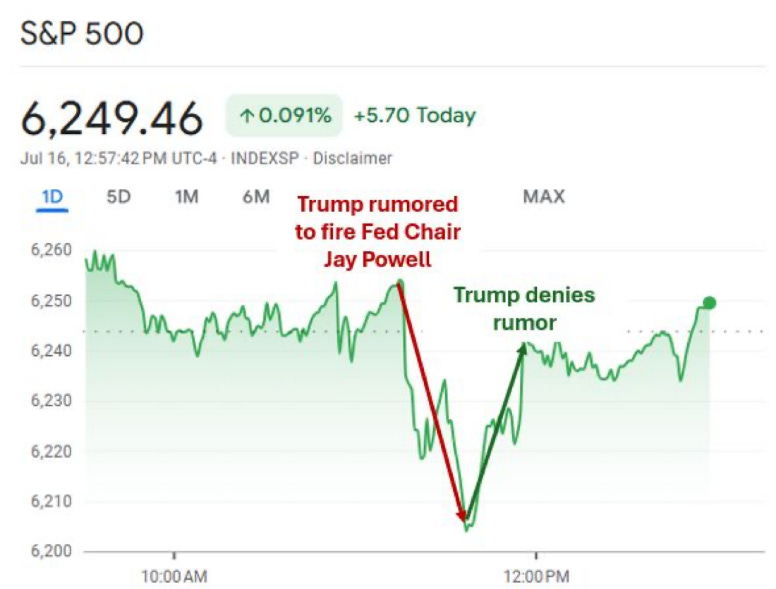

Just look at how the markets reacted:

The Federal Reserve is America's central bank. One pillar of our monetary policy, alongside us, the House Ways and Means Committee. So yes, we are talking about this today because we focus on tax policy and our nation’s economic bedrock (looking at you Social Security and Medicare) but also because we don’t want eggs to be 35% more expensive.

The Federal Reserve sets interest rates, manages inflation, and steers the economy through downturns or instability. It’s the key guardian of our financial system, and its independence is what gives global markets the confidence that our economic policy is grounded in data, not political whim.

No president in U.S. history has ever fired a Fed Chair. Why? Because the central banking system is predicated on independence. It’s the bedrock of our economic stability, and when political leaders seize control of monetary policy, markets tremble, investors flee, and workers and families pay the price.

Want to know what that looks like? This op-ed in the New York Times lays out how when political strongmen override central bank independence, inflation spirals and costs soar.

Economist Rebecca Patterson writes: “With these and other examples of economic mismanagement, why on earth would the Trump administration try to follow suit?”

The American people cannot afford this path. Even Trump’s Supreme Court has signaled this reckless move is illegal.

But it’s the path Trump and his enablers in Congress are dragging us toward. It’s these same people who are threatening the Fed who have already caused economic harm.

Just like the GOP’s Big Ugly Bill, Republicans are once again proving they can’t be trusted to manage the economy or govern for all.

Even hinting at firing the Fed Chair undermines the very trust that keeps our financial system stable, which hits workers and families harder than the wealthy and well-connected. It weakens the dollar. It raises borrowing costs. It tells the world that the U.S. economy is up for sale to the highest bidder.

At a moment when families are already feeling squeezed, we need leadership that strengthens economic institutions, not leaders who try to dismantle them in broad daylight.

We launched this newsletter to meet you where you are, and share our perspective on the ways and the means of economic policy. Follow along & share with a friend!